A discrepancy in retirement savings by race is important to talk about because it sheds light on more than just money.

The amount of money you have in your retirement savings account when you retire dictates how you can live in retirement – for example, whether you can afford life necessities or whether you’ll need to delay retiring and work more.

So, when we understand retirement savings by race, we can better understand how different populations will live and whether they are at risk for struggling in their older years. That way, we can help shape policies to strengthen society and aim for everyone to have a comfortable retirement.

Race and Retirement Savings: The Numbers

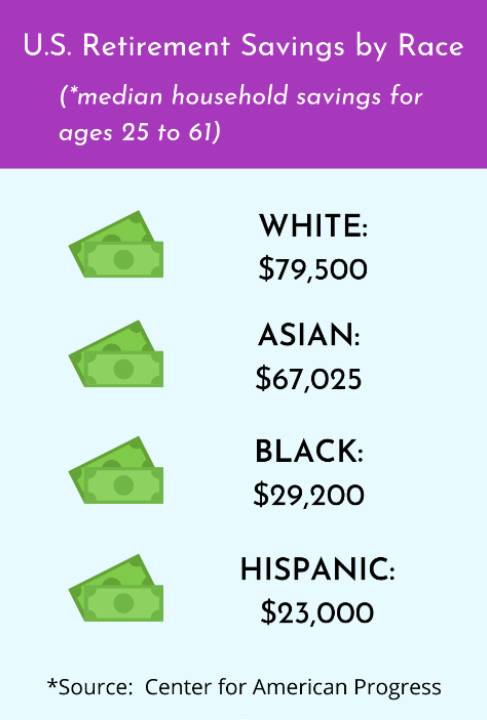

Minorities in the U.S. save substantially less than White Americans, according to National Retirement Risk Index (NRRI) from the Center for Retirement Research at Boston College. While 50% of all Americans are at risk for not being able to keep up their standard of living after retirement, the data shows that the risk is even greater for Black and Hispanic populations.

First, about half of Black and Hispanic Americans have no retirement savings at all. And those who do have substantially less saved than White Americans.

As you might guess from the retirement savings by race figures above, minorities indeed currently have less income in their retirement years. White Americans had a median retirement income of $23,292 in 2019, Blacks had $16,863 and Latinos had $13,560, according to a CNBC article citing The National Institute on Retirement Security

What Causes a Difference in Retirement Savings by Race?

The picture of what causes varying household economics is pretty complex. It’s hard to pinpoint one reason why minorities have a more difficult time securing retirement savings.

To better understand, we can turn to review the common paths toward building wealth and saving more for retirement. That way, we can then think about the different roadblocks people may be experiencing and how we can remove them.

Income

When you simply earn more money, you can more easily set aside more money for retirement. Higher incomes that easily cover necessary expenses like mortgage or rent, utilities, bills, and groceries can provide a healthy positive cash flow. That means you have extra money each month you can budget for whatever you like — including putting it toward savings goals.

Indeed, minorities do earn less than White Americans on average. Blacks earned 14.9% less than Whites in 2019, while Hispanics earned 10.8% less, according to the Economic Policy Institute. Keep in mind that when you earn more, you’ll also be in a higher bracket for Social Security income in your retirement years.

Employer Benefits

Minorities in the U.S. tend to hold more jobs that don’t offer strong retirement benefits compared to White Americans, who enjoy more pension plans and 401(k) programs. These employer-sponsored retirement plans make saving easier by automating savings from paycheck deductions. They also offer the major benefits of tax advantages and employer-matching additions that increase retirement savings.

About 66% of White employees have the opportunity to enroll in a retirement program through their work, whereas only 54% of Blacks and 35% of Hispanics have that same opportunity, according to the National Institute for Retirement Security. Of course, lack of access to these advantages presents a major setback for retirement savings.

Investment Choices

The amount of your retirement savings often hinges on how you invest what you do save. Some investors see annual returns in the double digits, while others see gains in the low single digits. Over time, through the power of compounding, your average annual earnings have a tremendous impact on how big your portfolio will be when you retire.

On average, Black and Hispanic Americans veer more toward safer but lower-yielding investment choices like bonds, CDs and savings accounts, according to the Social Security Administration report “Racial and Ethnic Differences in Wealth and Asset Choices.” White Americans are more likely to own higher-risk, but higher-yielding assets like riskier stocks.

Homeownership

When you retire, one option to provide you with money is to tap any home equity you have through a home equity line of credit or a reverse mortgage. This is basically a loan that uses the value of your home as collateral. So, when you sell your home (or it’s sold when you pass away), the money you receive goes to your reverse mortgage lender.

Unfortunately, this common financial tool, a great crutch during retirement, is not available for people who don’t own their own home.

And, in fact, minorities have lower levels of homeownership than White Americans. About half of Black and Hispanic households owned homes in the first quarter of 2020 versus nearly 75% of White households, data from Statista.com shows.

Setbacks from an Economic Crisis

When a population faces more struggles during normal economic times, you can imagine what happens when an economic crisis hits. What we saw during the last recession underscored discrepancies in wealth among the races, including in retirement savings.

When the economy collapses, we see job losses that lead to desperate decisions about money. Many people who lose their jobs turn to their save retirement money to fund necessities like food, housing, and utilities. Of course, if you’ve been earning less as minorities are, you’re likely to have a smaller emergency fund and tap into those retirement funds sooner.

Inherited Wealth

Another way people get a leg up on retirement savings is by inheriting money from their parents or grandparents. Here, again, minorities have a disadvantage in America, with White Americans inheriting more money on average, according to the Economic Policy Institute.

Of course, the main reason Whites inherit more is that the average wealth among White families is much higher – about 10-fold that of a Hispanic or Black household. Part of the reason why minority household wealth is lower is that, historically, minorities have faced many decades of struggles connected to race – from slavery to workplace discrimination.

Ways to Address Retirement Savings Discrepancies

With so many causes behind the retirement savings by race, you can imagine one solution won’t be enough. Instead, lawmakers can consider a range of policies or regulations that might help bridge the gap.

Among just some of the possible ways society might help minorities get a better footing on retirement savings:

- Improved access to employer-sponsored retirement savings programs

- Stronger housing programs that assist first-time, minority buyers

- More consideration for how any changes to Social Security may affect minorities, who depend more heavily on Social Security income during retirement

The Bottom Line

Many Americans are not saving enough for retirement, but the picture is especially bleak for minorities. Minorities in the U.S. are on track to have a more difficult retirement than White Americans, if today’s retirement savings trends are any indication.

Being aware of the differences in retirement savings and understanding some of the causes behind those differences are steps we all can take toward the long road to eliminating wealth gaps. This way, we can work to ensure we’re all on track to living a secure retirement.

Hope You Enjoyed the Read!

I agree with your point of view, your article has given me a lot of help and benefited me a lot. Thanks. Hope you continue to write such excellent articles.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/en/register?ref=P9L9FQKY

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?